Renters Insurance in and around Las Vegas

Your renters insurance search is over, Las Vegas

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

- Las Vegas

- Paradise

- Winchester

- Enterprise

- Spring Valley

- Henderson

- Summerlin

- N Las Vegas

- Sloan

- Whitney

- Boulder City

Protecting What You Own In Your Rental Home

You have plenty of options when it comes to choosing a renters insurance provider in Las Vegas. Sorting through deductibles and providers to pick the right one is a lot to deal with. But if you want great priced renters insurance, choose State Farm for covering all of your belongings and personal items. Your friends and neighbors enjoy unbelievable value and no-nonsense service by working with State Farm Agent Monica Gubler. That’s because Monica Gubler can walk you through the whole insurance process, step by step, to help ensure you have coverage for everything you own inside your rental, including jewelry, tools, home gadgets, electronics, and more! Renters coverage like this is what sets State Farm apart from the rest. Agent Monica Gubler can be there to help whenever mishaps occur, to help you submit your claim. State Farm provides you with insurance protection and is here to help!

Your renters insurance search is over, Las Vegas

Renters insurance can help protect your belongings

Why Renters In Las Vegas Choose State Farm

Renters insurance may seem like not a big deal, and you're wondering if it can actually help you. But pause for a minute to think about how difficult it would be to replace all the belongings in your rented property. State Farm's Renters insurance can help when unexpected mishaps damage your possessions.

As a reliable provider of renters insurance in Las Vegas, NV, State Farm aims to keep your life on track. Call State Farm agent Monica Gubler today for a free quote on a renters policy.

Have More Questions About Renters Insurance?

Call Monica at (702) 898-4663 or visit our FAQ page.

Simple Insights®

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

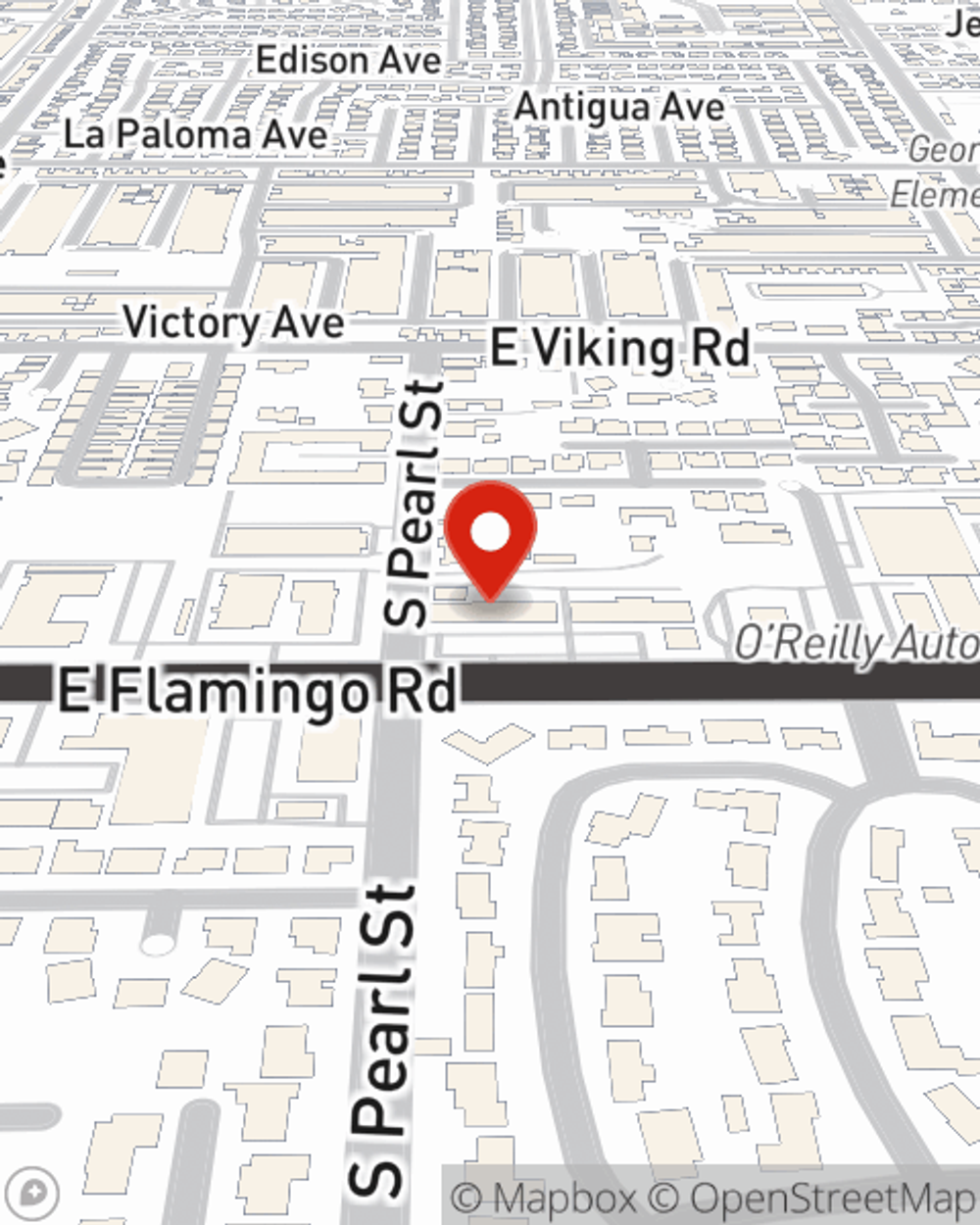

Monica Gubler

State Farm® Insurance AgentSimple Insights®

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.